Lost in the election chaos of the past week was the news that Bidenflation is still chugging along. Inflation came in lower than forecasted for October even though housing, food, and energy prices remained significant contributors to rising consumer prices.

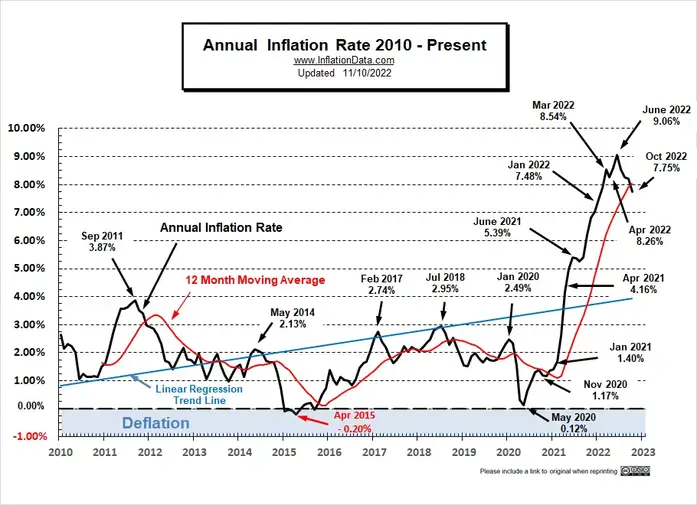

Since the 1970s, economists have used the most recently updated Bureau of Labor and Statistics (BLS) data to quantify the country’s economic health. To do so, they add the current U.S. unemployment rate, which ticked up to 3.7%, to October’s better-than-expected rate of U.S. inflation, which now stands at 7.75%. Originally coined as “the discomfort index” by intellectual powerhouse and policy economist Arthur M. Okun, the sum of these two rates is now known simply as the U.S. Misery Index and functions as a snapshot in time of America’s economy as a whole.

The current U.S. Misery Index stands at a crippling 11.45%.

Since unemployment and inflation significantly impact the average American wage earner’s spending power, the Misery Index also gauges the negative impact Bidenflation is having on the quality of American life. With inflation at historically high levels, it follows that as the Misery Index climbs, the quality of American life declines. And even though inflation crept down slightly in October, it shows no signs of cooling down, causing the Fed to raise interest rates to their highest levels since 2008.

October’s slight decline in the rate of U.S. inflation doesn’t mean that prices for goods and services fell; it simply means prices aren’t rising as quickly as they were earlier in the year. The most recent BLS news release stated that inflation hasn’t hit just one or two price sectors of the economy. The Consumer Price Index (CPI), which measures the overall change in prices consumers paid for goods and services, rose 0.4% in October. During the same period, the prices for shelter, gasoline, food, and electricity were the largest contributors to the monthly seasonally adjusted all-items increase. Motor vehicle insurance, recreation, new vehicles, and personal care were among those that increased over the month. Only used cars and trucks, medical care, apparel, and airline fares saw a slight decrease.

Recommended: Saving America: Why Blaming President Trump Has Little to Do With the Path to Victory in 2024

With everyday consumer prices at or near record highs, many Americans plan to cut back on holiday spending and travel. And who can blame them? According to AAA, Sunday’s national average for gasoline was $3.776 per gallon, which is down $0.137 per gallon from October but $0.362 per gallon higher than a year ago. Gas prices in the Western states remain exceedingly high; for example, California has an average price of $5.441 per gallon.

US wage growth has failed to keep pace with rising consumer prices for a record 19 consecutive months. This is a decline in prosperity for the American worker and the primary reason why the Fed will continue to hike rates.

Charting via @ycharts pic.twitter.com/BnPqRKh2pe

— Charlie Bilello (@charliebilello) November 10, 2022

More stagnant wage growth, soaring prices, climbing mortgage rates, growing credit card debt, and no end in sight — all thanks to Biden & Co.’s disastrous economic policies — beg the question, ‘Is this really what Americans — especially Gen Z — voted for on Nov. 8? And if so, why?

Biden has promised to do nothing to change his policies. In fact, one day after last week’s election, he said, “I’m confident these policies are working and that we’re on the right path, and we need to stick with them.” As we barrel headlong toward an economic depression fueled by the failed policies of the Democratic Party, I sincerely hope Gen Z thinks about that every time they pay the student loan payments that Good Ol’ Benevolent Lying Joe said he’d forgive.

Join the conversation as a VIP Member